Global expansion offers companies exciting opportunities like new revenue streams and access to larger talent pools. However, one challenge global companies face is determining whether their international business activity triggers permanent establishment (PE).

If a business unknowingly creates a permanent establishment in another country, it is subject to local taxes and may face tax arrears, fines, and reputational damage if it fails to comply.

This guide provides a quick checklist to help you determine if your international business activity triggers permanent establishment. Plus, find answers to your permanent establishment questions, including how to avoid permanent establishment risk.

Table of Contents

- Permanent Establishment Meaning

- Permanent Establishment Checklist

- What Makes Permanent Establishment a Risk?

- Protect Your Business with an Employer of Record

- Permanent Establishment FAQs

Permanent Establishment Meaning

Permanent establishment is a status international companies receive when regularly operating through a fixed place of business or dependant agent in a foreign country. When companies prompt this status, they become subject to local corporate taxation.

The criteria that determine a fixed place of business vary worldwide. However, any regular business activity that generates ongoing revenue for the home enterprise, like sending agents overseas for contract signing or negotiation, generally causes permanent establishment.

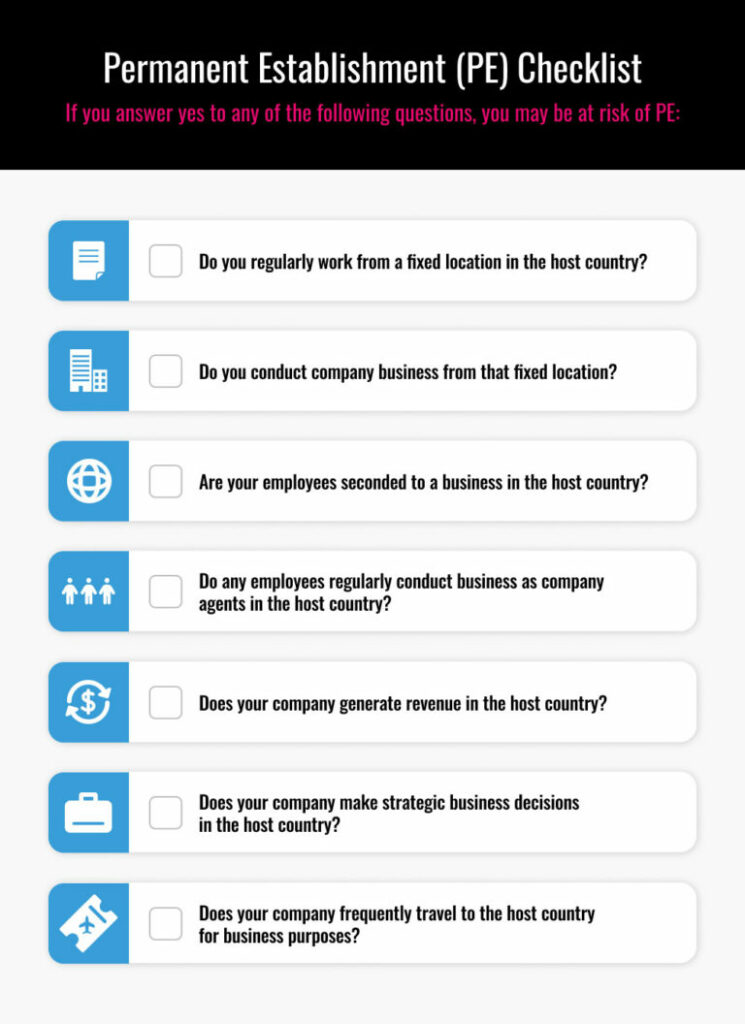

Permanent Establishment Checklist

Use the following checklist to determine if your international business activity creates a permanent establishment.

Does your company regularly work from a fixed location? This fixed location does not have to be a place only your company uses. It could be a co-working space or an office you rent when you are in the country. If it’s yours to use, it may increase your risk of permanent establishment.

Do you conduct company business from that fixed location? The type of business you conduct abroad is an important aspect of permanent establishment. For example, managing your business operations from a fixed space abroad may cause permanent establishment. However, if you only earn rental income abroad, you may avoid creating a permanent establishment but could still be subject to corporate income tax.

Are your employees seconded to a business in the country? In some instances, seconded employees, or employees temporarily assigned to work abroad, create a permanent establishment risk for their home company.

Do any employees regularly conduct business as company agents in the country? Ongoing agent activity abroad directly linked to product and service sales, such as contract signing or negotiation, increases your permanent establishment risk.

Does your company generate revenue in the country? If foreign personnel directly contribute to your company’s overall ongoing revenue, this can prompt permanent establishment.

Does your company make strategic business decisions in the country? If company executives convene or hold board meetings in the country, this can indicate permanent establishment.

Does your company frequently travel to the country for business purposes? If a company representative regularly travels abroad for business purposes, this increases your permanent establishment risk. A company cannot avoid permanent establishment simply because its employees abroad are not residents.

What Makes Permanent Establishment a Risk?

When operating internationally, companies risk unknowingly creating a permanent establishment and overlooking the related tax liability in a particular country. This oversight leads to noncompliance penalties, like tax arrears, fines, and reputational damage.

Global companies must consider each factor that may initiate permanent establishment in the host country and be aware of the related tax liabilities.

Protect Your Business with an Employer of Record

Clarifying your permanent establishment status and fulfilling local tax responsibilities is key to ensuring global compliance. Still, doing so without legal consultation presents significant risks for global companies. You can eliminate risks by working with an employer of record (EoR).

An EoR acts as the legal employer of your foreign talent and handles all employee and employer tax-related responsibilities per local tax laws, so you can rest assured you’re in compliance. Partnering with an EoR also eliminates the need to establish legal entities to remove the risk of permanent establishment in markets where you conduct business.

Learn more: What Is an Employer of Record?

Permanent Establishment FAQs

Below are answers to commonly asked questions about permanent establishment.

What Is Required for Permanent Establishment?

If a business regularly operates in a foreign market with a fixed presence, it triggers permanent establishment and creates a local tax liability. The criteria for a fixed presence generally include any ongoing activity directly linked to product and service sales or activity that generates ongoing revenue for the home company.

For example, renting out an office or co-working space for remote employees in a foreign country or company agents regularly traveling abroad for contract negotiation can indicate permanent establishment.

How Do I Avoid Permanent Establishment Risk?

Some companies may establish a legal entity to avoid permanent establishment risk and simplify their tax obligations across multiple countries. However, entity establishment is a costly and time-consuming process and doesn’t always align with a company’s goals.

Instead, companies can avoid permanent establishment risk without setting up a legal entity by partnering with an employer of record (EoR). An EoR acts as a company’s legal entity and manages foreign talent and tax compliance on the company’s behalf.

What Happens If I Have a Permanent Establishment?

If your international business activity triggers permanent establishment, your company is subject to corporate taxes in the local jurisdiction. While international tax treaties outline tax liabilities for foreign companies, permanent establishment laws trump tax treaties in some jurisdictions.

What Is a Permanent Establishment Certificate?

A permanent establishment certificate is an unofficial term that usually refers to documentation confirming a foreign company’s permanent establishment status in the host country.

Additionally, in some countries, a No Permanent Establishment Certificate is a document that allows a non-resident who generates local income to pay a lower tax rate than that of the residents in the same income bracket.

What Is the 183-Day Rule in Permanent Establishment?

The 183-day rule typically allows individuals to avoid paying local income taxes if they reside in a country for less than 183 days a year. While this rule generally isn’t a permanent establishment criterion, the duration and nature of an employee’s work in a foreign country can cause permanent establishment, which often trumps treaty relief for a company’s employees.

Therefore, global companies often consider the 183-day rule and permanent establishment criteria together to avoid noncompliance when working with a globally distributed workforce.

What Constitutes a U.S. Permanent Establishment?

U.S. tax treaties define permanent establishment as a foreign company that regularly operates through a fixed place of business in the United States or through a dependent agent in the U.S. who regularly exercises the authority to sign contracts on behalf of the foreign company.

Foreign companies do not have a permanent establishment in the U.S. if they only conduct preparatory work there or operate through an independent broker based in the U.S. who acts in the ordinary course of their business as an independent agent.

Author: